Overview

- Yunfeng purchased 10,000 ETH for about $44 million after board approval, using internal cash on Sept. 2.

- The ether will be treated as a strategic reserve and recorded in the company’s financial statements.

- The transaction was kept below Hong Kong’s 5% notifiable threshold, with a pledge to follow disclosure rules if holdings increase.

- The company views Ethereum as infrastructure for tokenizing real-world assets and for testing applications in its insurance and fintech businesses.

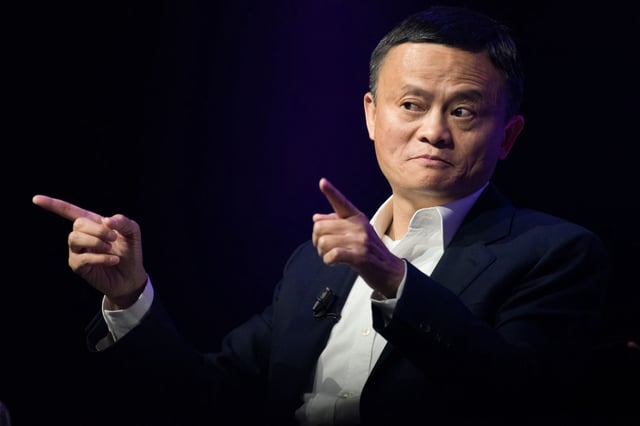

- Shares closed up 9.55% on the announcement, and the firm—majority-owned by Jack Ma co-founded Yunfeng Capital—warned that crypto markets remain highly volatile.