Overview

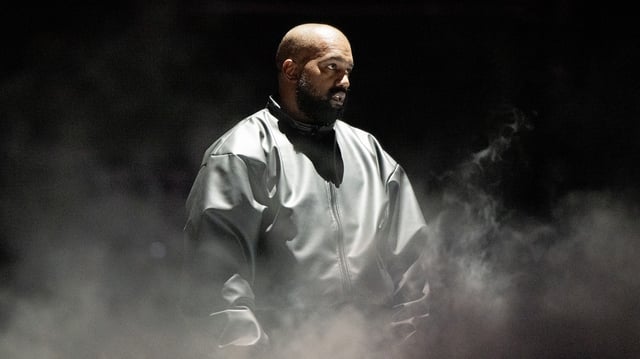

- Ye promoted the Solana-based YZY token on his verified X account as part of the broader YZY Money plan that also pitches Ye Pay and a YZY Card.

- The coin’s market value spiked to roughly $3 billion within about 40 minutes of launch before sliding sharply within hours and trading far below its peak.

- Project documents and on-chain snapshots show an allocation of about 70% to Yeezy Investments LLC, 20% to the public, and 10% to liquidity with vesting via Jupiter Lock.

- The team published 25 candidate contract addresses to deter sniping, yet analysts including Lookonchain identified wallets that appeared to know the correct address in advance and booked seven-figure profits.

- Liquidity was initially seeded with only YZY tokens, a single-sided design that can facilitate outsized exits, as Nansen tallied roughly $50.4 million in realized profits versus $21.4 million in losses among the top 500 wallets.