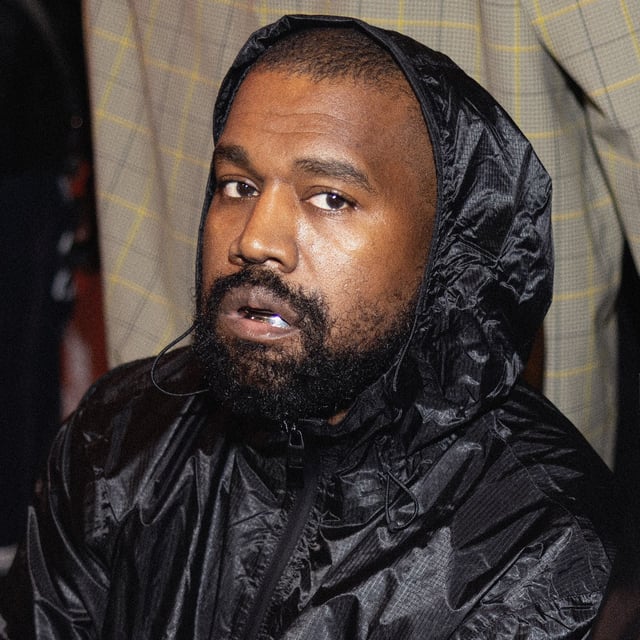

Overview

- YZY launched on Solana as the centerpiece of a YZY Money initiative, with the website promoting Ye Pay for processing and a YZY Card for spending YZY and USDC.

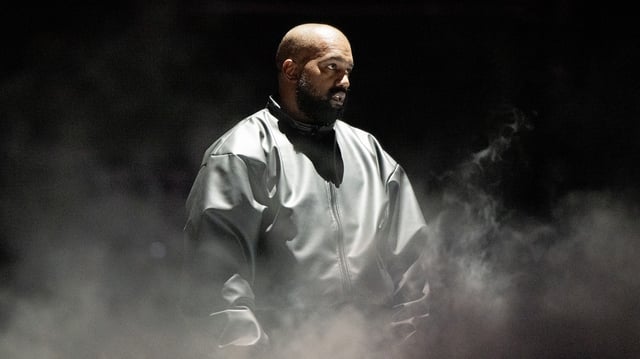

- The token’s market cap spiked to roughly $3 billion within about 40 minutes before sliding below $1 billion within hours, with prices retreating from above $3 to near $1.

- Project materials show 20% of supply for the public, 10% for liquidity, and 70% controlled by Yeezy Investments LLC under a Jupiter Lock vesting schedule, while Bubblemaps and other trackers highlight heavy concentration in a small set of wallets.

- The team’s 25-address anti-sniping setup did not prevent privileged early entries, with Lookonchain citing wallets that bought before most traders and one example realizing over $1.5 million in profit within hours.

- Liquidity was seeded as YZY-only on Solana DEXs such as Meteora and Raydium, a structure analysts say enables large holders to add or remove liquidity to cash out, with Nansen data showing top wallets netting $50.4 million in profits versus $21.4 million in losses in early trading.