Overview

- On August 1 afternoon in Tokyo, the yen exchanged hands at about ¥150.53–55 per dollar, near its weakest level in four months.

- U.S. inflation data on July 31 exceeded forecasts and pushed back expectations for early Federal Reserve rate cuts.

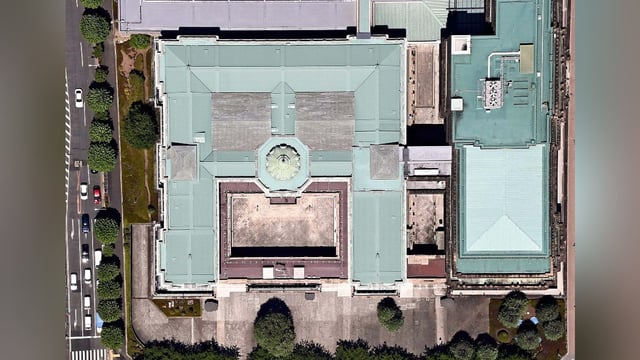

- The Bank of Japan maintained its policy rate at 0.5% at the July 31 meeting, widening the yield gap with the United States.

- Heavyweight semiconductor shares fell after Tokyo Electron’s earnings miss, driving the Nikkei 225 down 270.22 points to 40,799.60.

- Export-sensitive sectors, led by automakers, rallied on the yen’s depreciation, lifting the Yomiuri 333 index to a record closing level.