Overview

- XRP traded around $2.88–$2.90 on Aug. 20 after a weeklong slide, with buyers repeatedly defending the $2.85–$2.88 zone and near-term resistance building at $2.92–$3.04.

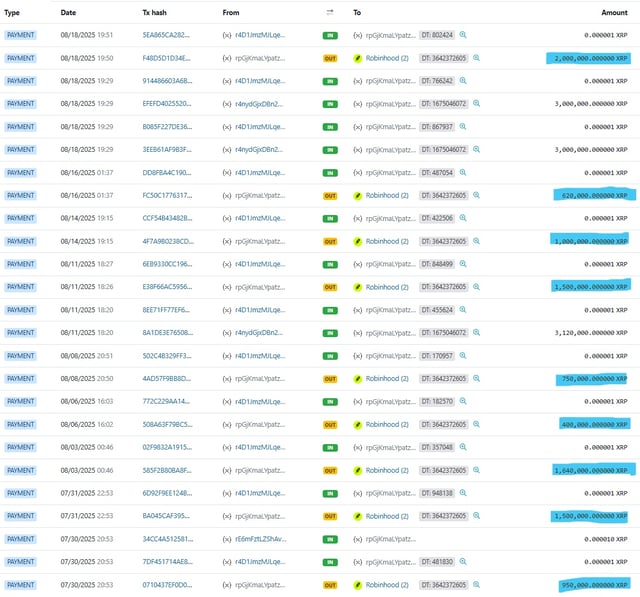

- Large holders offloaded roughly 470 million tokens over 10 days, coinciding with elevated volumes and reinforcing short-term selling pressure.

- The SEC pushed decisions on multiple spot-XRP ETF filings, including Nasdaq’s CoinShares application, to October, and a separate audit ranked the XRP Ledger lowest among 15 blockchains.

- On-chain data show only 5.66% of supply sits on centralized exchanges and about 93.5% of circulating XRP remains in profit, suggesting tight immediate sell liquidity alongside scope for profit-taking.

- Derivatives positioning highlights more than $1.84 billion in shorts between roughly $3.04 and $3.42, setting up squeeze potential if bulls reclaim the $3.05–$3.15 area, while downside watchers flag $2.80–$2.70 as next supports.