Overview

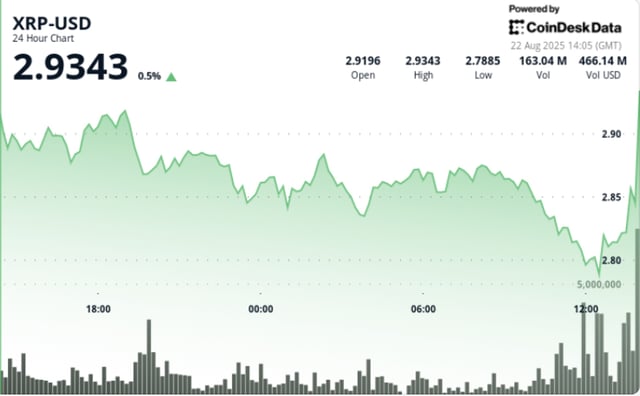

- A late-week bounce following rate-cut hints from Fed Chair Jerome Powell helped XRP reclaim the $3 area, yet rallies continue to stall near the $3.00–$3.06 band with support clustered at $2.80–$2.85.

- On-chain and spot data show elevated turnover and institutional-sized flows, while CoinShares reported $125.9 million of inflows into XRP exchange-traded products last week.

- Roughly $470 million in whale selling over about 10 days has weighed on price, though analysts describe the activity as redistribution; a break below $2.80 could open room toward $2.75–$2.60.

- Short‑term signals are mixed as a TD Sequential buy flag and accumulating wallets suggest scope for a move toward $3.15–$3.30, even as range‑bearish setups persist below key moving averages.

- Regulatory timing and product expansion remain in focus, with SEC decisions on XRP ETFs pushed to October and Ripple planning an RLUSD stablecoin launch in Japan with SBI in early 2026.