Overview

- The court-approved reorganization cut roughly 70% of Wolfspeed’s debt, reduced annual cash interest expense by about 60%, and extended maturities to 2030.

- All legacy common stock was canceled, with prior shareholders receiving only a small slice of the reorganized equity as most ownership shifted to creditors and backstop investors.

- The NYSE suspended trading in the old shares and plans to delist them on Oct. 10, while substituted new stock under the same ticker contributed to trading halts and misleading percentage moves.

- Retail interest spiked, with heavy Reddit and Stocktwits activity fueling meme-like trading even as analysts flagged ongoing execution and profitability risks.

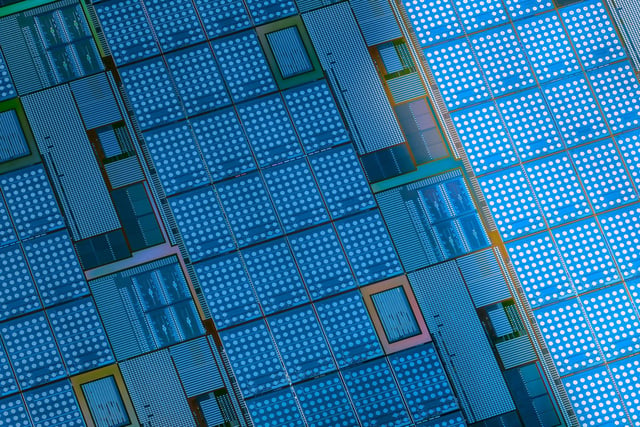

- Wolfspeed refreshed its board, including the departure of its chairman, and will reincorporate in Delaware, while emphasizing continued operations and its vertically integrated 200mm silicon carbide footprint.