Overview

- The team repurchased about 6.04 million WLFI using $1.06 million in protocol fees, then burned 7.89 million tokens across Ethereum and BNB.

- Roughly 3.06 million WLFI on Solana remains earmarked for future burns, according to on‑chain updates.

- The buyback-and-burn program is funded only by fees from WLFI‑managed liquidity and excludes third‑party or community pools.

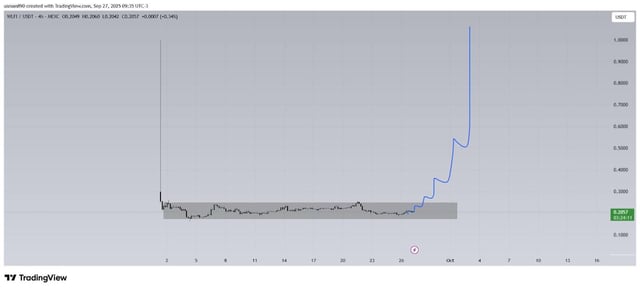

- WLFI traded around $0.205 on Saturday, posting a short‑term rebound while still more than 38% below its high.

- Entities linked to the Trump family are reported to control a multibillion‑dollar WLFI position following recent unlocks, underscoring holder concentration.