Overview

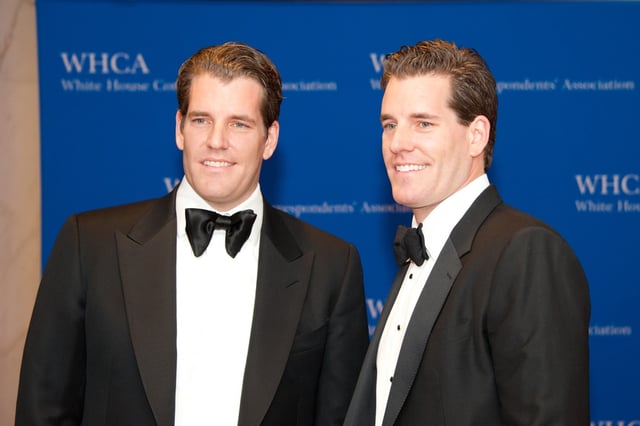

- On July 25, Gemini co-founder Tyler Winklevoss said JPMorgan paused the exchange’s re-onboarding in direct response to his July 19 criticism of its new data-access fees.

- JPMorgan defends the fee structure as necessary to curb nearly two billion monthly third-party data requests unrelated to customer activity and to protect consumers.

- The CFPB’s Section 1033 open banking rule would guarantee consumers free access to their banking data through aggregators such as Plaid, but banks are challenging its implementation by imposing charges.

- Industry figures including Kraken co-CEO Arjun Sethi and CoinMetrics co-founder Nic Carter warn that data-access fees amount to anti-competitive monetization and mirror past Operation Choke Point 2.0 debanking tactics.

- While awaiting clarity on its JPMorgan status, Gemini is courting alternative banking partners and expanding its international derivatives operations.