Overview

- A mid-August Tax Foundation analysis forecasts an average $3,752 federal tax cut per individual filer in 2026 and roughly 938,000 full-time equivalent jobs over the long run.

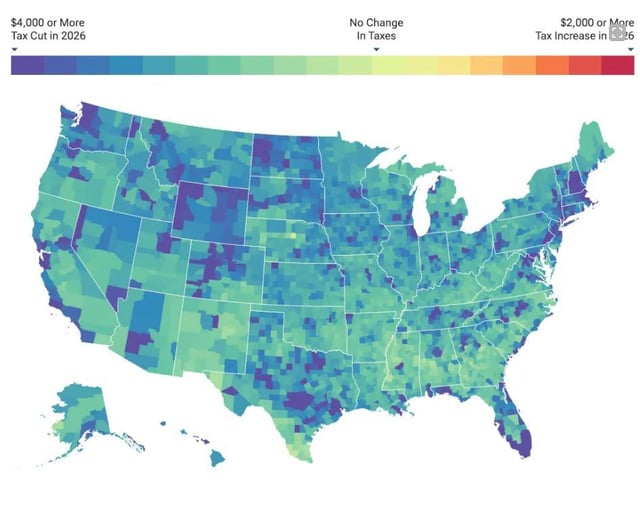

- Average savings vary sharply by location, with top cuts in Wyoming, Washington and Massachusetts and resort counties such as Teton County, Wyoming, expected to exceed $37,000 per taxpayer.

- The Congressional Budget Office estimates the law will add about $2.4 trillion to the federal deficit over the next decade, with interest costs pushing the total even higher.

- Offsetting measures like tighter work requirements for Medicaid and SNAP risk coverage losses for lower-income households while shifting benefits toward higher earners, who could gain an average $13,600 annually.

- Some tax provisions—including SALT deductions and temporary exclusions—are set to phase out or adjust over 2026–35, driving average savings to dip to $2,505 by 2030 before climbing again.