Overview

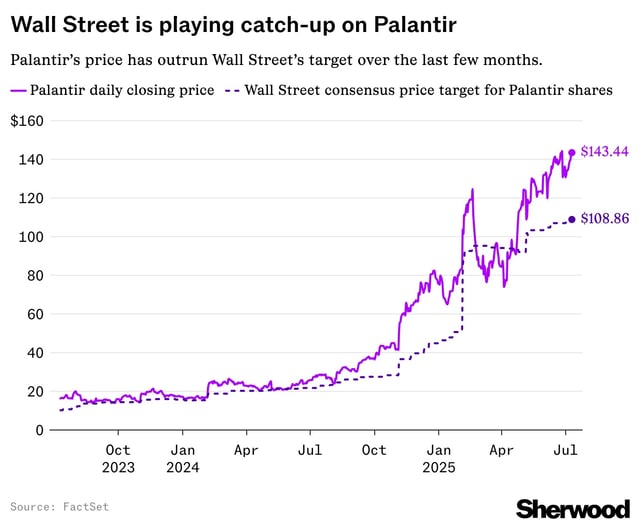

- Palantir shares have climbed about 90% year-to-date and traded near their June all-time high after strong AI growth signals

- Wedbush maintained an Outperform rating, citing bootcamp-driven AIP sales cycles and a technological moat that could rival Oracle’s

- Veteran analyst Stephen Guilfoyle set the highest Wall Street target at $181, highlighting Palantir’s expanding defense and commercial intelligence footprint

- Visible Alpha’s surveyed analysts hold neutral or sell ratings with a mean price target of $97, underlining concerns over the stock’s premium multiples

- Palantir’s AI Platform deployments and federal partnerships—including recent work with Accenture at DHS and HHS—support expectations for over $1 billion in U.S. commercial revenue