Overview

- Wealthsimple now offers home delivery of Canadian and U.S. dollars on demand through its zero-fee chequing account

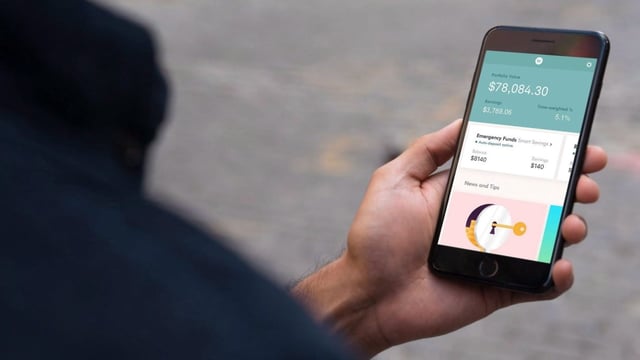

- Customers can send paperless cheques, mobile bank drafts and free domestic wire transfers via the mobile app

- The new unlimited cash-back credit card delivers 2 percent back on every purchase with no foreign transaction fees and waived fees for clients meeting asset or deposit thresholds

- A secured line of credit with rates starting at 4.45 percent will launch later in 2025 with instant approval against client holdings

- Wealthsimple partners with ten Schedule 1 banks to hold deposits and extend Canada Deposit Insurance Corporation coverage up to $1 million per client