Overview

- Buffett's Berkshire Hathaway cut its Apple stake by 55%, retaining 400 million shares worth $84 billion.

- Despite the sale, Apple remains Berkshire's largest holding, making up 29% of its portfolio.

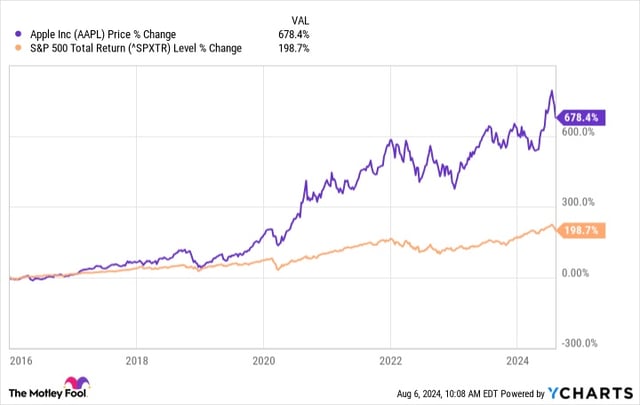

- Buffett cited concerns over Apple's valuation and future outlook as reasons for the reduction.

- Berkshire Hathaway has repurchased $5 billion of its own shares, indicating confidence in its long-term value.

- Analysts suggest the move aligns with Buffett's strategy to maintain liquidity and manage tax liabilities.