Overview

- July nonfarm payrolls rose by only 73,000, far below forecasts and marking the weakest gain in months.

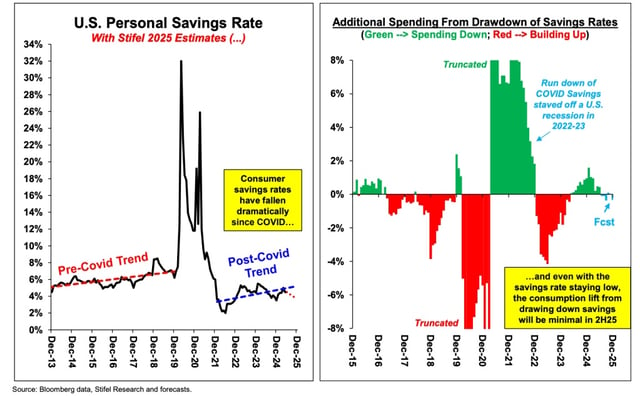

- Stifel strategists Barry Bannister and Thomas Carroll warn that fading pandemic-era stimulus and sluggish real wage growth could trigger a more than 10% S&P 500 pullback as stagflation risk rises.

- Morgan Stanley’s Lisa Shalett cautions that rising reciprocal tariffs near 18% may drive up inflation and squeeze corporate margins.

- Chief strategist Mike Wilson argues that April’s sell-off priced in the slowdown, setting the stage for an early-cycle market upswing.

- Analysts cite AI-driven corporate capital spending as a key support for earnings, though many warn this tech-capex cycle may plateau.