Overview

- U.S. equities powered by AI optimism and strong earnings pushed the S&P 500 and Nasdaq to fresh all-time highs on widespread expectations of near-term Fed rate cuts.

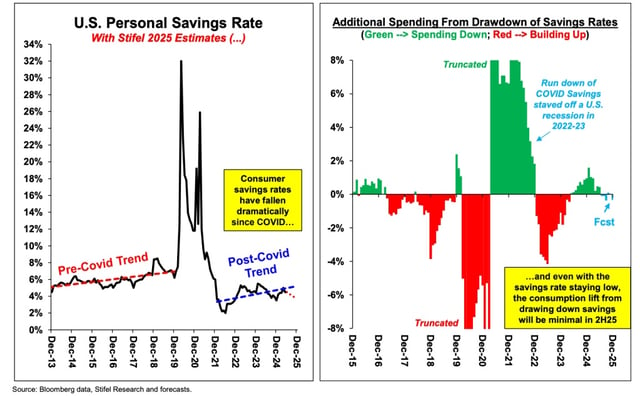

- Stifel strategists Barry Bannister and Thomas Carroll argue that the unwinding of a COVID-era “money illusion” and slowing real wage growth set the stage for a more than 10% S&P 500 correction.

- Morgan Stanley’s Mike Wilson counters that the spring sell-off already factored in worst-case slowdown risks and that the market may be entering the early innings of a new bull phase.

- July’s consumer price index held steady at 2.7% year-over-year while recent jobs reports showed hiring cooled, leaving traders to balance rate-cut hopes against sticky inflation and tariff pressures.

- Market valuations are highly concentrated in a handful of large-cap names, with Apollo’s Torsten Slok noting the top 10 S&P 500 stocks are pricier than during the late-1990s tech boom.