Overview

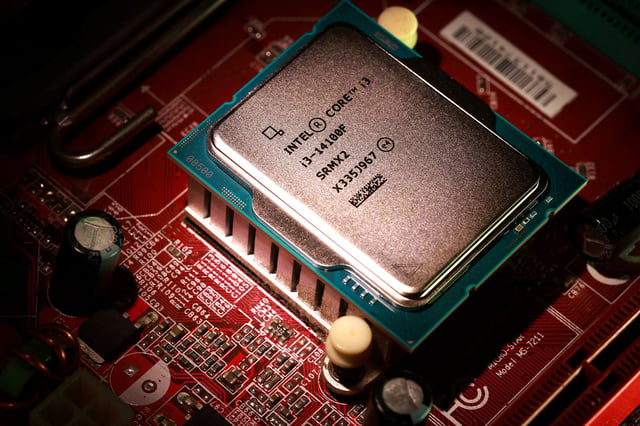

- Washington converted roughly $8.9 billion in previously committed grants into 433.3 million Intel shares at $20.47 each, taking a passive stake with no board seat and a five‑year warrant for up to an additional 5% if Intel loses majority control of its foundry unit.

- Commerce Secretary Howard Lutnick said the administration is weighing stakes in defense contractors such as Lockheed Martin, indicating the approach could extend beyond semiconductors.

- National Economic Council Director Kevin Hassett called the Intel deal a down payment on a possible sovereign wealth framework and said more transactions in other industries are likely.

- Republican senators including Rand Paul and Thom Tillis criticized the move as a step toward state ownership, and legal experts questioned whether the CHIPS Act permits converting grants into equity.

- Intel said the shares were issued at a discount; the stock is up roughly 4–5% since the announcement as the company grapples with losses, layoffs, and project delays, and it warned in a filing the arrangement could add regulatory and commercial risks.