Overview

- The government will buy 433.3 million new shares at $20.47 each for roughly a 9.9% stake, funded by $5.7 billion in CHIPS Act awards plus $3.2 billion from the Secure Enclave program, with closing expected Aug. 26.

- Intel disclosed that the discounted issuance is dilutive, reduces other investors’ voting influence, and could complicate access to future grants while inviting foreign subsidy restrictions that may weigh on sales.

- Non‑U.S. markets made up 76% of Intel’s 2024 revenue, including 29% from China, a concentration the company says could be affected by the U.S. becoming a significant shareholder.

- The White House describes the holding as passive with no board seat or special governance rights and says it will generally vote with Intel’s board; a five‑year warrant allows an additional 5% purchase if Intel no longer holds majority ownership of its foundry business.

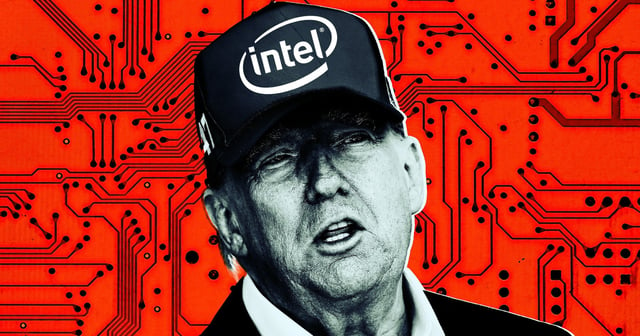

- President Trump touted the deal and promised more like it, while economic chief Kevin Hassett said similar equity transactions are possible in other sectors, even forming the basis for a U.S. sovereign‑wealth‑style approach, as legal scholars question the CHIPS Act authority for such conversions.