Overview

- Intel disclosed new risk factors in an SEC filing, warning the U.S. stake could hurt international sales, complicate foreign regulations, and limit access to future grants, with the share issuance diluting existing investors.

- The government is purchasing 433.3 million newly issued shares for $8.9 billion at $20.47 each by converting $5.7 billion in CHIPS grants and $3.2 billion from the Secure Enclave program, with closing expected Aug. 26.

- Terms include a five-year warrant allowing the U.S. to buy an additional 5% if Intel ceases to control its foundry, while the stake carries no board seat or governance rights and the government agrees to vote with Intel’s board in most cases.

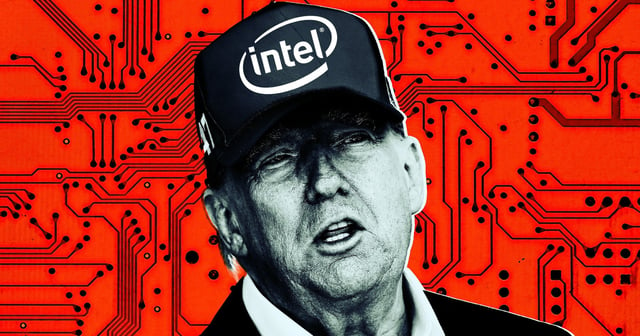

- President Trump said he would pursue similar transactions and claimed he “paid zero” for Intel, as National Economic Council Director Kevin Hassett described the move as a step toward a potential U.S. sovereign wealth fund.

- Legal and political scrutiny is mounting over whether the CHIPS Act permits grant-to-equity conversions, even as Intel shares rose following the announcement and the government becomes the company’s largest single shareholder.