Overview

- Washington converted about $11.1 billion in CHIPS Act funds and related support into a roughly 9.9% non-voting equity stake in Intel, with no board seat, according to filings.

- Intel warned in an SEC filing that the deal dilutes existing shareholders, reduces voting rights, and could harm international sales or trigger additional foreign regulations.

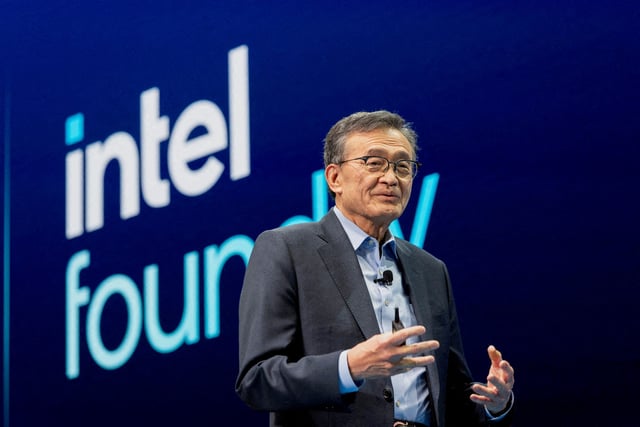

- Fitch said the transaction does not improve Intel’s BBB credit rating, and CEO Lip-Bu Tan said the company did not need the money; SoftBank invested $2 billion days before the announcement.

- Trump said he would pursue more arrangements and aides have discussed building toward a sovereign wealth fund, drawing sharp criticism from free‑market conservatives and praise from Sen. Bernie Sanders.

- Commerce’s Lutnick suggested defense firms could be next, while investors and governance experts cautioned about conflicts between national goals and shareholder interests and raised insider‑trading and regulatory concerns.