Overview

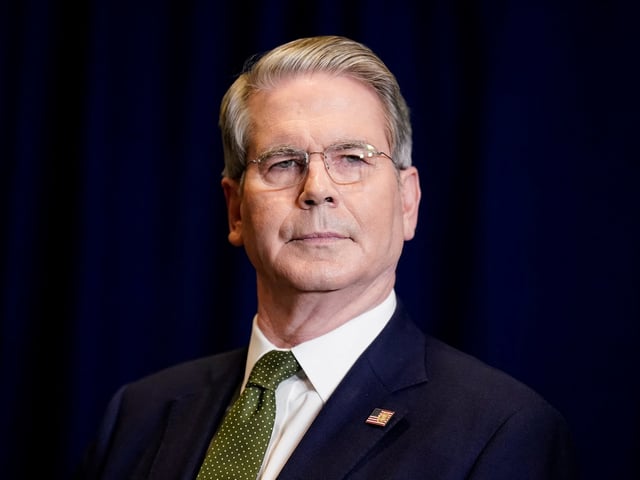

- Treasury Secretary Scott Bessent said the Exchange Stabilization Fund could deploy currency swap lines, direct foreign‑exchange intervention and purchases of Argentina’s dollar sovereign bonds.

- Argentine assets surged after the signal, with sovereign dollar bonds up as much as 18%, equities rising about 17% and the peso strengthening, as the central bank refrained from intervening that session.

- Morgan Stanley judged near‑term liquidity risks lower but kept a neutral stance on Argentine debt, highlighting Global 2029 and Global 2030 for potential outperformance and GD38 if support proves more durable.

- S&P Global Market Intelligence forecasts a post‑election shift away from the current moving‑band system toward tighter exchange‑rate controls, with the scale and form of U.S. backing shaping the path.

- Key parameters remain undefined, and analysts are referencing Mexico’s 1995 ESF program for clues on possible fiscal conditions and guarantees, with formalization in Argentina expected via a presidential decree and later congressional ratification.