Overview

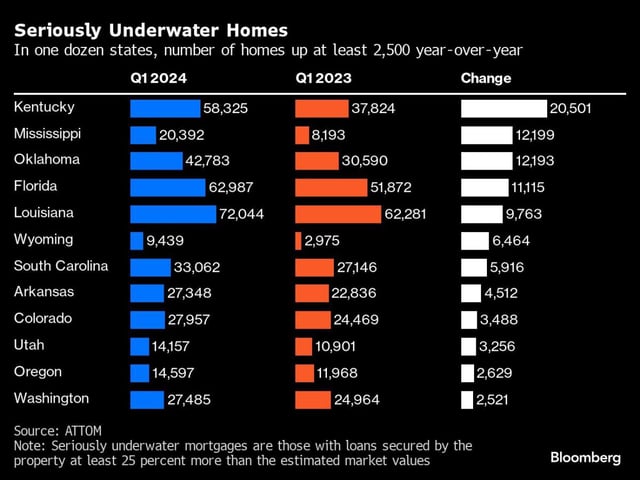

- The percentage of U.S. homes with mortgages considered 'seriously underwater' increased to 2.7% in Q1 2024, up from 2.6% in the previous quarter.

- Kentucky, West Virginia, and Oklahoma reported the highest increases in seriously underwater mortgages, with Kentucky leading at 8.3%.

- The proportion of equity-rich homes declined nationally, signaling a drop in financial security for many American homeowners.

- Southern states experienced the most significant rise in underwater mortgages, correlating with regional economic challenges.

- Experts suggest the spring buying season will be crucial in determining long-term market trends amid these shifts.