Overview

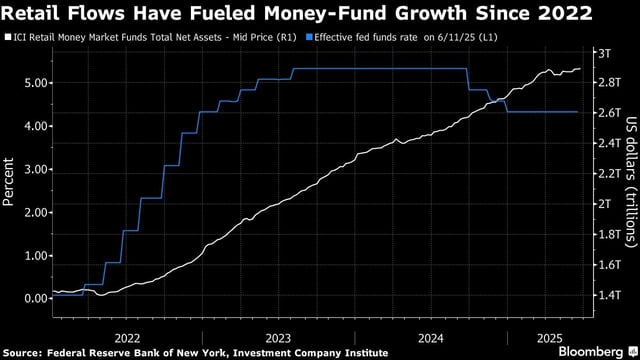

- US money-market funds now hold a record $7.4 trillion in assets following sustained inflows this year

- Investors have contributed over $320 billion so far in 2025 and $902 billion over the past twelve months

- The average simple seven-day yield stands at 3.95% for government funds and 4.03% for prime funds

- Fund managers are extending weighted-average maturities and boosting repurchase-agreement allocations to lock in elevated returns and address debt-ceiling uncertainty

- Projections for Fed rate cuts in September and October are driving strategic adjustments in money-market portfolios