Overview

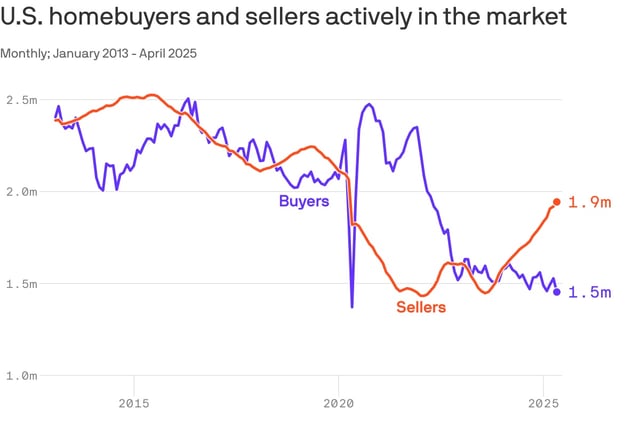

- Active home sellers outnumbered buyers by nearly 490,000 in April, the widest gap on record since Redfin began tracking in 2013.

- Inventory climbed to 1,965,532 homes for sale in April, up 16.3 percent year-over-year, with the total dollar value hitting an unprecedented $698 billion.

- Elevated borrowing costs have dampened transactions, driving April home sales down 3.1 percent year-over-year and leading 19.9 percent of sales to involve price reductions.

- The easing of the mortgage rate lock-in effect has freed more homeowners to list properties, but subdued demand has shifted bargaining power to buyers.

- Redfin forecasts a modest 1 percent decline in national home prices by the end of 2025 as growing supply and persistent affordability challenges weigh on values.