Overview

- Commerce Department data show first-quarter FDI fell to $52.8 billion from a revised $79.9 billion in Q4 2023, the weakest quarterly inflow since late 2022.

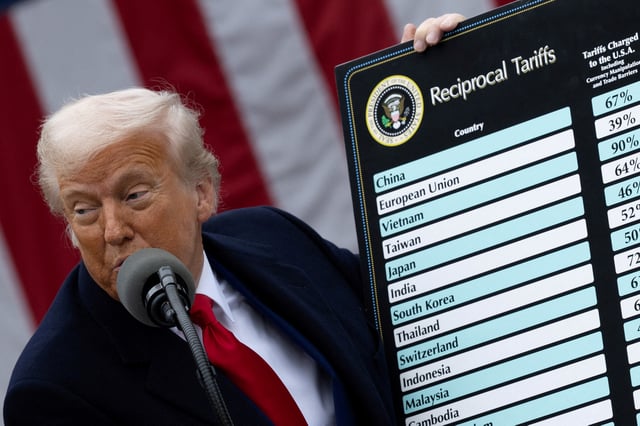

- Elevated business uncertainty over President Trump’s proposed tariff plans is cited as the primary factor behind the investment pullback.

- The FDI slump helped drive the U.S. current-account deficit up to $450.2 billion, as firms front-loaded imports to sidestep expected duties.

- Nippon Steel’s $14.9 billion acquisition of U.S. Steel and $21 billion in U.S. manufacturing investments from Hyundai Motor and Hyundai Steel are slated to boost future inflows.

- Economists warn that quarterly FDI figures are inherently volatile due to one-off mergers and big projects but anticipate inflows to rebound as announced foreign manufacturing projects get underway.