Overview

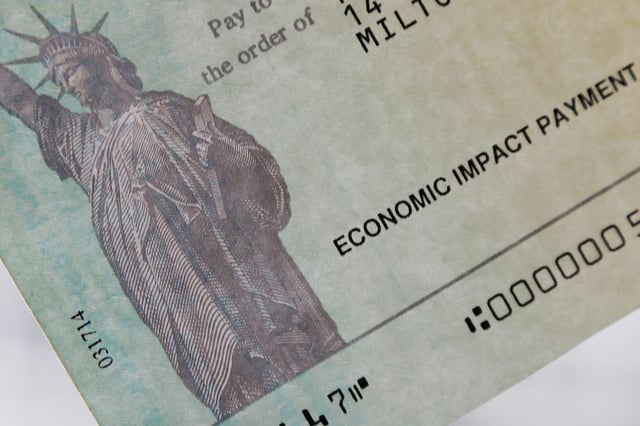

- Starting Sept. 30, the Social Security Administration stopped routine paper checks for Social Security and SSI, directing remaining recipients to direct deposit or the Treasury-backed Direct Express card.

- The IRS began phasing out paper tax refund checks today, with refunds moving to electronic delivery while filing procedures remain unchanged until new guidance arrives before the 2026 filing season.

- Fewer than 1% of Social Security beneficiaries still received paper checks—about 400,000 people—an often vulnerable group that advocates warn could face access challenges.

- Treasury cites security and savings, noting paper checks are about 16 times likelier to be lost or stolen and cost roughly $0.50 each versus under $0.15 for electronic transfers.

- Limited waivers apply for specific hardships such as age 90 or older, certain mental impairments, or remote locations, and agencies advise caution about scam attempts targeting new electronic users.