Overview

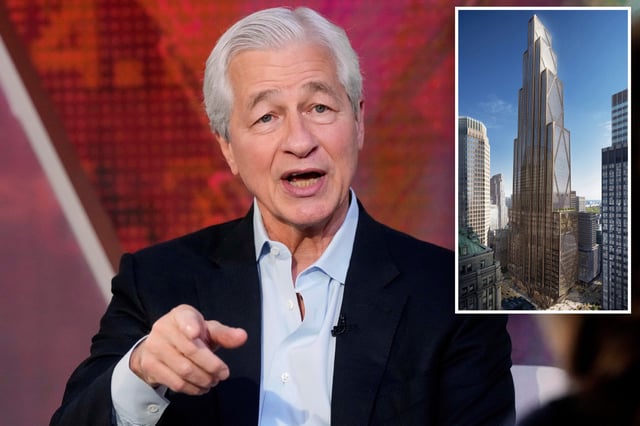

- Jamie Dimon said on Fox Business that rising US debt and pandemic-era spending could widen credit spreads and squeeze small-business and real-estate lending.

- He cautioned that a loss of confidence in the dollar might trigger sharp volatility across high-yield and leveraged loan markets.

- Scott Bessent told CBS News that Dimon’s past bond-market crisis calls have not materialized and outlined plans to lower the deficit over the next two years.

- Market data indicate 30-year Treasury yields have topped 5% for the first time since before the Great Recession and Moody’s downgraded US debt in May.

- A House-approved spending bill projected to add $2.5 trillion to the deficit over ten years has drawn criticism from figures including Elon Musk for worsening fiscal imbalances.