Overview

- Intel confirmed the conversion of about $11.1 billion in CHIPS and related funds into a roughly 9.9% passive stake with no board seats and limited voting commitments for the Commerce Department.

- President Trump said he intends to pursue additional transactions and advisers have floated a sovereign‑wealth‑style framework, while Commerce Secretary Howard Lutnick highlighted defense contractors such as Lockheed Martin.

- In a detailed securities filing, Intel warned of dilution and reduced voting power for existing shareholders, potential loss of overseas customers, exposure to foreign subsidy rules, limits on future grants, and possible litigation.

- Investors and governance experts cautioned that federal ownership could blur corporate and national objectives and called for guardrails to address risks such as insider trading and conflicts of interest.

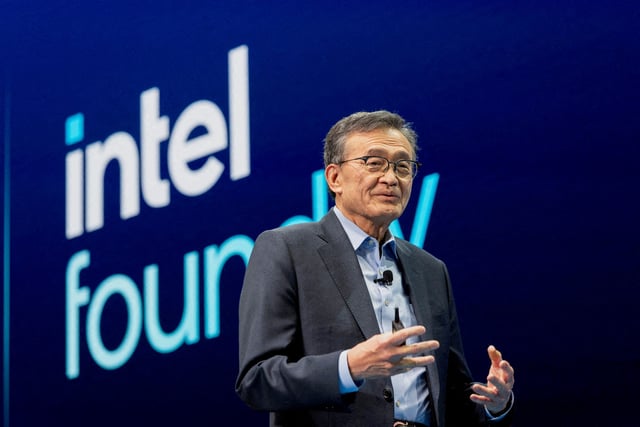

- Fitch Ratings said the stake provides liquidity but does not improve Intel’s BBB credit profile or underlying chip demand, and the deal followed Trump’s public pressure on CEO Lip‑Bu Tan before a White House meeting.