Overview

- New York Fed survey showed one-year inflation expectations fell to 3.2% in May after Trump eased severe tariff threats.

- Economists forecast May’s CPI rose about 2.5% year-over-year with core CPI climbing 0.3% month-to-month, its largest gain since January.

- The Federal Reserve, which measures its 2% target using the PCE price index rather than CPI, is poised to leave its 4.25%–4.50% policy rate unchanged at the June 17–18 meeting.

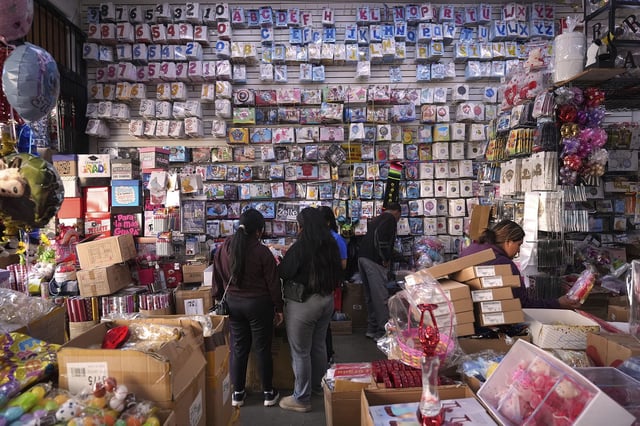

- Retailers such as Walmart have signaled upcoming price hikes as higher import duties begin filtering through supplier inventories.

- The Bureau of Labor Statistics has reduced its CPI data collection following staffing cuts, prompting concerns about higher volatility in future inflation reports.