Overview

- The Treasury said it directly purchased Argentine pesos and completed a $20 billion currency swap framework with Argentina’s central bank after meetings with Economy Minister Luis Caputo and coordination with the IMF.

- Markets rallied on the announcement, with the peso strengthening to roughly 1,418–1,450 per dollar before trading ended and Argentina’s 2035 bond rising 4.6 cents to about 60.58 cents on the dollar.

- Treasury Secretary Scott Bessent said the United States stands ready to take exceptional measures to stabilize markets and argued Argentina’s policies are sound when anchored by fiscal discipline.

- The department declined to provide details on the size of the peso purchases or the mechanics of the swap line, prompting calls for greater transparency from observers.

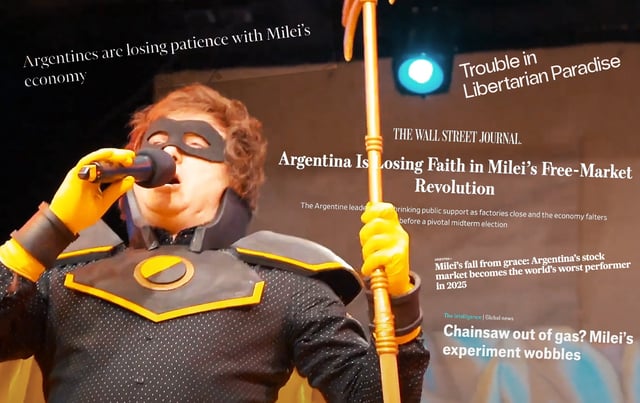

- Critics in the United States described the action as a bailout and politically tinged support for President Javier Milei, while Bessent disputed that label, as Milei prepares to meet President Trump on October 14 ahead of Argentina’s October 26 midterms.