Overview

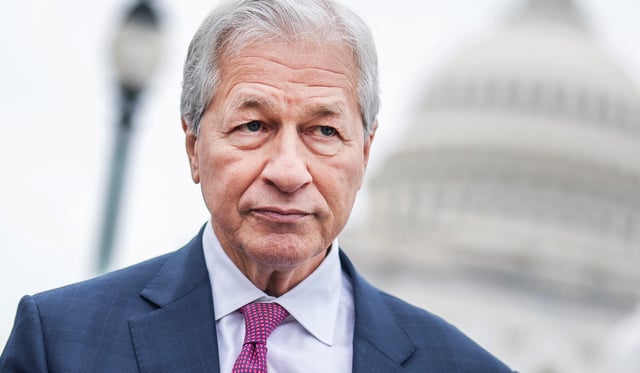

- JPMorgan Chase is advancing its client-only deposit coin and laying groundwork for wider stablecoin offerings under Jamie Dimon’s direction.

- Citigroup and Bank of America are refining their own stablecoin prototypes and intend to launch them once client demand and legal clarity emerge.

- Morgan Stanley remains in an exploratory phase, assessing potential stablecoin use cases for its institutional clients without firm launch plans.

- The House of Representatives failed to advance the bipartisan GENIUS Act this week, leaving private stablecoin issuance frameworks in limbo.

- Banks view stablecoins as full-reserve, programmable payment tools that could boost 24/7 settlement capabilities and counter fintech competitors.