Overview

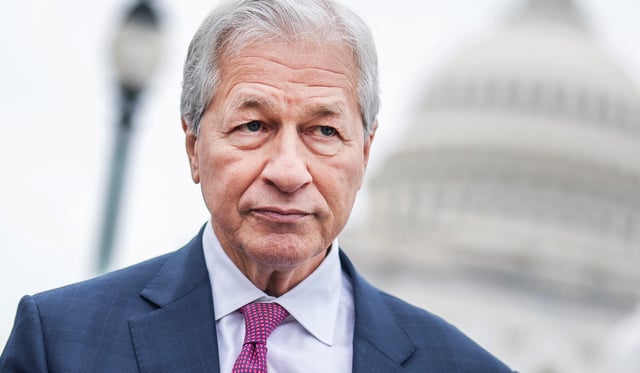

- JPMorgan Chase will expand its proprietary deposit coin and explore universal stablecoins despite CEO Jamie Dimon’s public skepticism.

- Citigroup CEO Jane Fraser says the bank is exploring issuance of a Citi stablecoin for cross-border payments and related reserve management.

- Bank of America has laid groundwork for stablecoin offerings but intends to launch a product only once client demand and legal guidelines are clear.

- Mastercard positions its network as a bridge for minting, distribution and redemption of stablecoins through existing payment rails.

- Analysts at Standard Chartered forecast stablecoin reserves could reach $750 billion by 2026, potentially reshaping U.S. Treasury issuance and the dollar yield curve.