Overview

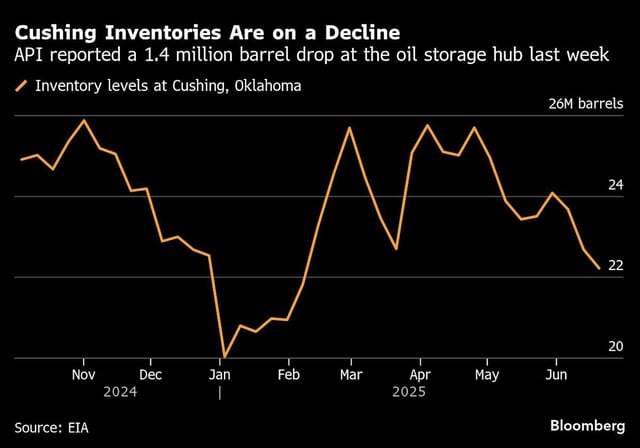

- API data showed U.S. crude inventories climbed by 680,000 barrels in the week to June 27, snapping a five-week draw that totaled over 22 million barrels.

- The U.S. Department of Energy reported a 300,000-barrel refill of the Strategic Petroleum Reserve, bringing stocks to 402.8 million barrels, still well below pre-drawdown levels.

- Brent crude hovered near $67.15 per barrel and WTI around $65.55 as mixed inventory signals countered a weaker dollar and reduced Middle East risk premiums.

- Gasoline supplies rose by 1.92 million barrels but remained 3% below the five-year seasonal average, while distillates fell 3.458 million barrels and sat 20% under five-year norms.

- Kpler figures showed Saudi oil exports jumped by 450,000 barrels per day in June and analysts forecast OPEC+ will restore its full 2.2 million bpd of cuts by the end of the third quarter.