Overview

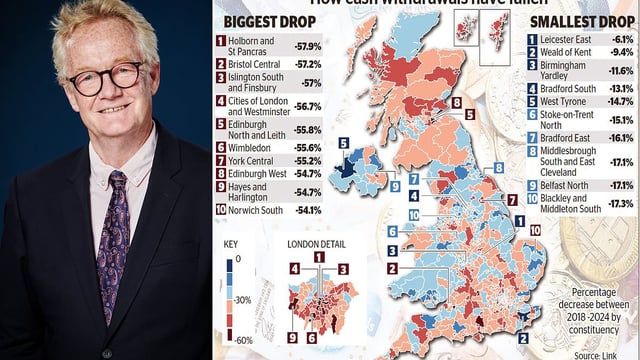

- Cash usage in the UK has dropped from 51% of payments in 2013 to just 12% in 2023, raising concerns about accessibility for vulnerable groups.

- The Treasury Committee has called for annual reporting on cash acceptance levels to prevent exclusion of elderly, disabled, and economically disadvantaged individuals.

- MPs warn that businesses may need to be legally mandated to accept cash if safeguards for those relying on physical currency are not implemented.

- At least 158 banking IT outages since 2023 highlight the critical role of cash in ensuring payment resilience during technological failures.

- The government continues to expand banking hubs but has no current plans to compel businesses to accept cash, despite growing concerns.