Overview

- ONS earnings data for May to July indicate a 4.7% increase would drive the triple-lock uprating in April 2026, subject to the September CPI figure on 22 October and a final decision on 26 November.

- The full new State Pension is projected to rise to about £241.05 a week (around £12,534–£12,535 a year), with the old basic rate moving to roughly £184.75 a week.

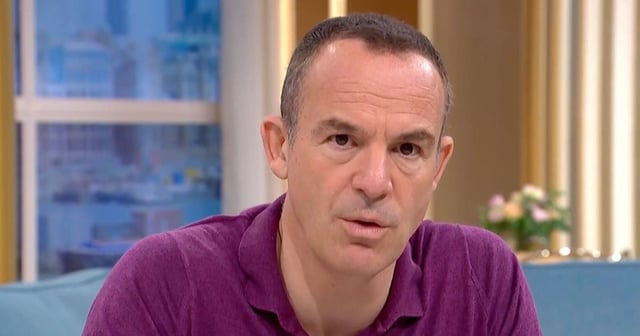

- With the personal allowance frozen at £12,570, the new annual amount would sit within pounds of the tax-free threshold, and Martin Lewis cautions some pensioners could face income tax for the first time if nothing changes.

- Experts warn frozen tax bands will pull more retirees into taxation, with potential HMRC clawbacks and unexpected bills highlighted by Kevin Mountford of Raisin UK and Claire Trott of St. James's Place.

- About 453,000 pensioners living in countries without reciprocal uprating agreements will not receive the increase, as campaigners renew pressure over long-standing frozen pensions.