Overview

- ONS earnings data point to an earnings-led 4.7% uprating from April 2026, lifting the full new state pension to about £241.05 a week (£12,534 a year) and the basic rate to £184.75.

- Work and Pensions Secretary Pat McFadden says the triple lock will be maintained during this Parliament, with the 2026 uprating expected to be confirmed at the 26 November Budget.

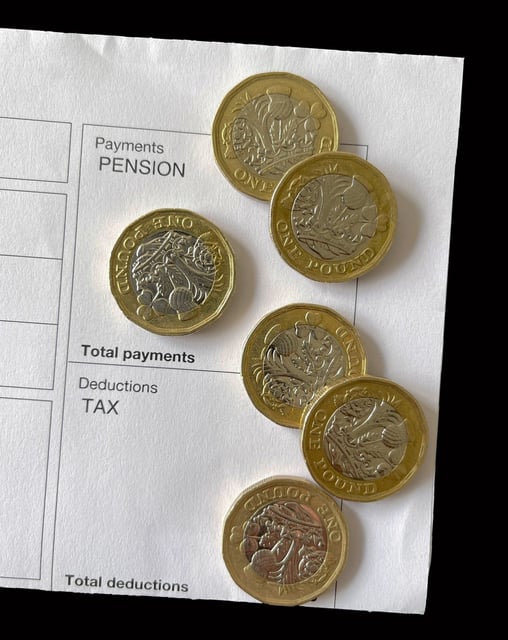

- With the personal allowance frozen at £12,570 until at least 2028, experts say the full new state pension is likely to exceed the threshold in 2027, pushing many to pay income tax for the first time.

- FCA figures show pension withdrawals topped £70bn in 2024–25, up about 36% year on year, as advisers cite panic reactions to policy uncertainty, including DC pots entering IHT from April 2027 and the tax‑free access age rising to 57 in April 2028.

- Roughly 435,000–453,000 expatriate pensioners in countries without uprating agreements will miss future increases, and IFS research warns recent state pension age rises have heightened poverty risks, particularly for women.