Overview

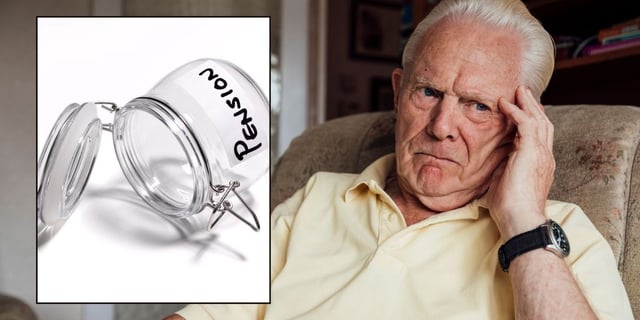

- The full new state pension increased by 4.1% this April to £11,973 annually, leaving only a £600 gap below the £12,570 personal allowance threshold.

- The personal allowance, frozen since 2021 and set to remain so until 2028, creates fiscal pressure as pension increases approach taxable levels.

- If the state pension surpasses the tax-free threshold, pensioners could face income tax liabilities and lose access to critical benefits like Pension Credit, potentially forfeiting over £8,000 in annual support.

- Pensioners with no other taxed income may need to file complex self-assessment tax returns, which experts warn could cost more than the pension increase itself.

- The Conservative Party previously proposed a 'triple lock plus' mechanism to align pensioners' personal allowance with the triple lock increases, but no action has been taken on this plan.