Overview

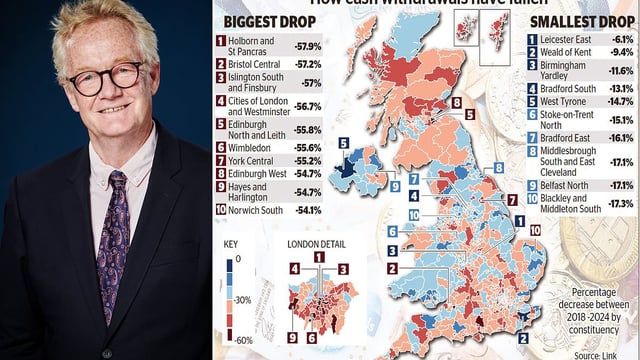

- Cash usage in the UK has dropped from 51% of payments in 2013 to just 12% in 2023, raising concerns about access and inclusion.

- The Treasury Committee warns that declining cash acceptance risks creating a 'two-tier society,' excluding vulnerable groups such as the elderly, disabled, and domestic abuse survivors.

- MPs recommend annual monitoring of cash acceptance levels and suggest the government may need to mandate cash acceptance if safeguards are not implemented.

- The report highlights the importance of cash for emergency preparedness, citing 158 bank IT outages since 2023 and urging households to hold cash in case of crises.

- While the government plans to expand banking hubs, it currently has no plans to compel businesses to accept cash, despite calls for stronger protections.