Overview

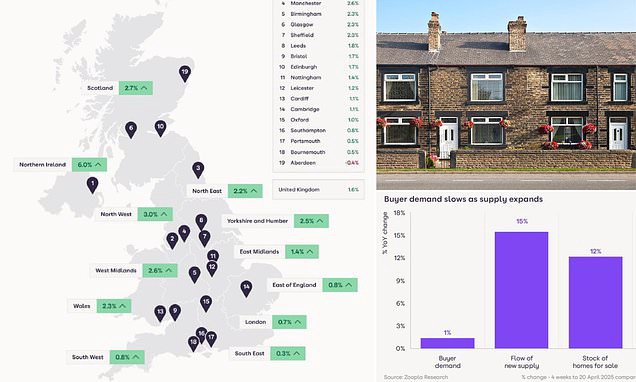

- House price growth slowed to 1.6% year-on-year in March 2025, down from 1.9% in December 2024, with the average home now valued at £268,000.

- Increased housing supply, with estate agents listing an average of 34 homes compared to 31 a year earlier, has tempered price momentum.

- Major banks, including HSBC and Barclays, have reduced mortgage rates below 4%, enhancing borrowing power for prospective buyers.

- The Financial Conduct Authority is reviewing mortgage lending rules to streamline affordability tests, potentially unlocking more buying opportunities.

- Zoopla forecasts a 5% increase in property sales this year, driven by pragmatic pricing and stronger activity in more affordable regions like the North and Midlands.