Overview

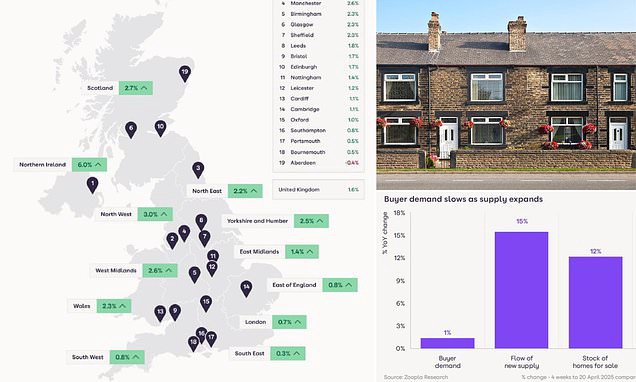

- House price growth slowed to 1.6% in the year to March 2025, down from 1.9% in December 2024, reflecting seasonal and economic pressures.

- The average UK home price increased by £4,270 year-on-year, reaching £268,000, as supply rose faster than buyer demand.

- Mortgage lenders, including HSBC UK, have introduced rate cuts and adjusted affordability stress tests, potentially increasing borrowing power.

- Zoopla forecasts a 5% rise in sales volumes for 2025, driven by affordability improvements in the North and Midlands.

- Record rental costs—averaging £1,349 outside London and £2,698 in London—continue to strain household budgets, influencing buyer behavior.