Overview

- UK banks and building societies are reporting the fastest growth in mortgage losses since the financial crisis, with a significant increase in households failing to keep up with repayments.

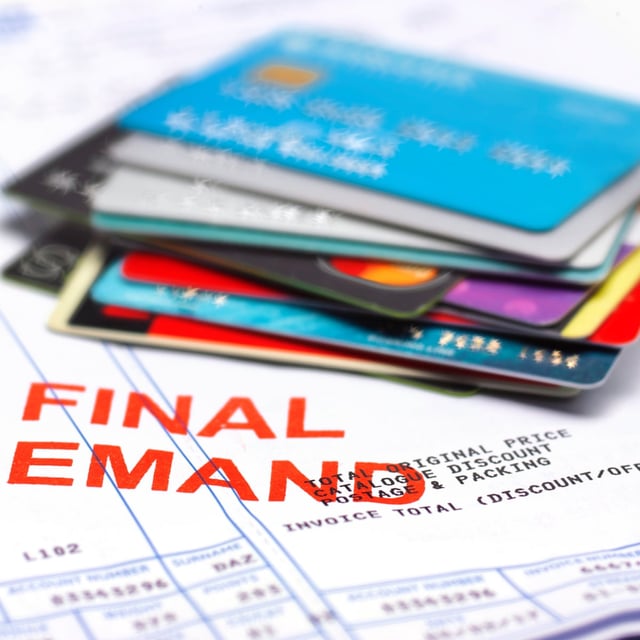

- Defaults on unsecured debt, including credit cards and loans, are also expected to rise sharply, marking the highest increase since 2009.

- The rise in defaults and losses is attributed to rapidly rising interest rates, with the Bank of England raising rates from 0.1% in December 2021 to 5.25% currently.

- Despite a recent drop in mortgage rates, banks are bracing for losses to continue mounting in the coming months.

- Although demand for new mortgages and credit card lending fell in the final quarter of 2023, both are expected to increase in early 2024.