Overview

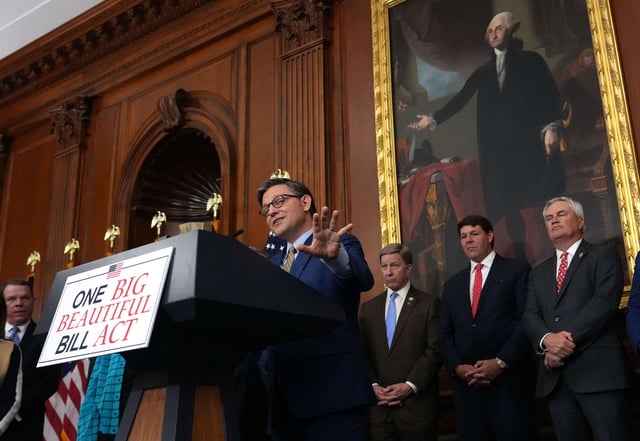

- The House approved President Trump's tax-and-policy reconciliation bill by a 215-214 vote, with all Democrats and two Republicans opposing it.

- Key provisions include making the 2017 Trump tax cuts permanent, raising the SALT deduction cap to $40,000 for most filers, and cutting $625 billion from Medicaid.

- The Congressional Budget Office projects the legislation will add $3.8 trillion to the national debt over the next decade and reduce resources for the lowest-income households.

- Senate Republicans, including Sen. Ted Cruz, have indicated substantial revisions will be required, particularly on deficit concerns and Medicaid provisions.

- The bill advances under budget reconciliation rules, allowing passage with a simple majority, but any Senate changes will require reconciliation with the House version before final approval.