Overview

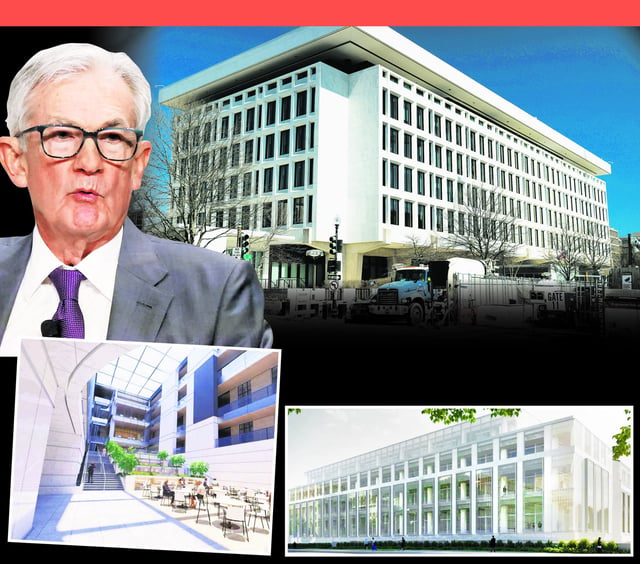

- At a July 8 Cabinet meeting, Trump called Jerome Powell “terrible,” demanded his immediate resignation and pressed for steep interest rate cuts.

- Trump pointed to a Council of Economic Advisers study led by Dr. Stephen Miran that claimed tariffs had zero impact on inflation to support his rate-cut push.

- Surveys from the Atlanta and Richmond Federal Reserve banks and Dun & Bradstreet show mixed signals on inflation versus growth, reinforcing the Fed’s caution on cutting rates.

- Powell and the Federal Open Market Committee have held the benchmark rate at 4.25%–4.50% since December, citing tariff uncertainties and incoming economic data.

- As Powell’s term ends in May 2026, Trump says he has narrowed his replacement shortlist to three or four rate-cut advocates, intensifying debates over central bank autonomy.