Overview

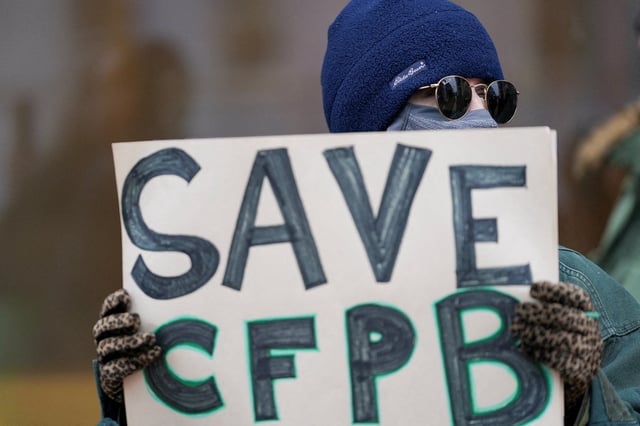

- The CFPB has been ordered to cease operations under acting director Russell Vought, following his appointment by President Trump after firing Rohit Chopra earlier this month.

- The Trump administration, supported by Elon Musk's Department of Government Efficiency, is pushing to defund and dismantle the CFPB, citing its alleged lack of accountability and excessive budget.

- Consumer advocates, including Elizabeth Warren, warn that eliminating the CFPB could leave consumers vulnerable to predatory financial practices and erode critical protections established after the 2008 financial crisis.

- The CFPB has returned over $21 billion to consumers since its founding in 2011, addressing issues like overdraft fees, credit card late fees, and medical debt reporting inaccuracies.

- Critics argue that the move to shut down the CFPB may benefit financial institutions at the expense of consumers, as the agency's enforcement and regulatory actions have been paused indefinitely.