Overview

- The Trump administration is prioritizing reducing 10-year Treasury yields to address high borrowing costs for consumers, particularly in the housing market.

- Despite Federal Reserve rate cuts in late 2024, 10-year Treasury yields have risen, contributing to mortgage rates that remain near 7%, limiting housing affordability.

- Experts cite economic uncertainty, inflation concerns, and fiscal policies, such as proposed tariffs and tax cuts, as drivers of stubbornly high yields.

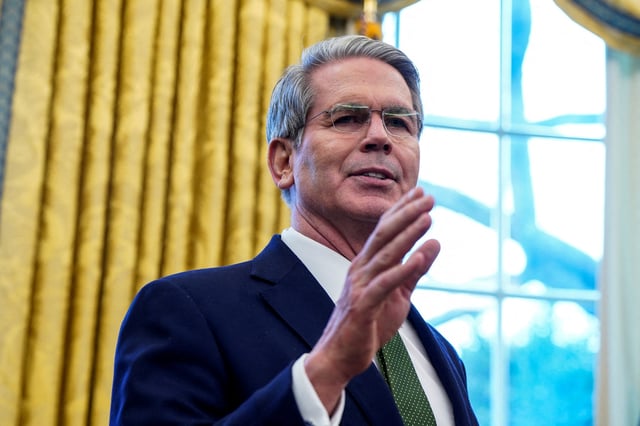

- Treasury Secretary Scott Bessent emphasized the administration's focus on achieving non-inflationary growth while fostering innovation in digital financial technologies like blockchain and stablecoins.

- Economists warn that prolonged high yields could slow economic growth, increase consumer financial strain, and make historically low mortgage rates unlikely to return.