Overview

- The ceasefire between Israel and Iran has held since Tuesday despite initial violations, easing safe-haven demand that had driven Treasury gains.

- In early Wednesday trading the 10-year Treasury yield held near 4.28% while oil prices dipped after fears of broader Middle East supply disruptions eased.

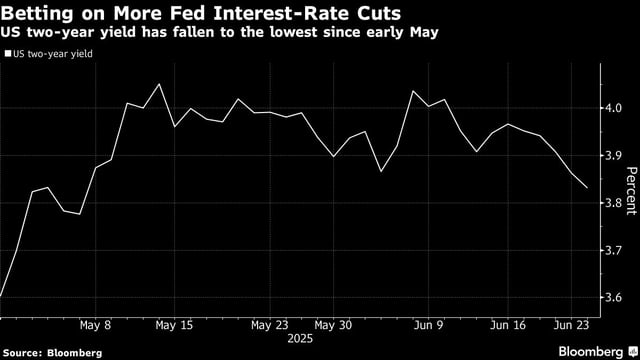

- Federal Reserve Governor Michelle Bowman and other officials signaled support for potential interest rate cuts, indicating a shift toward a more accommodative stance.

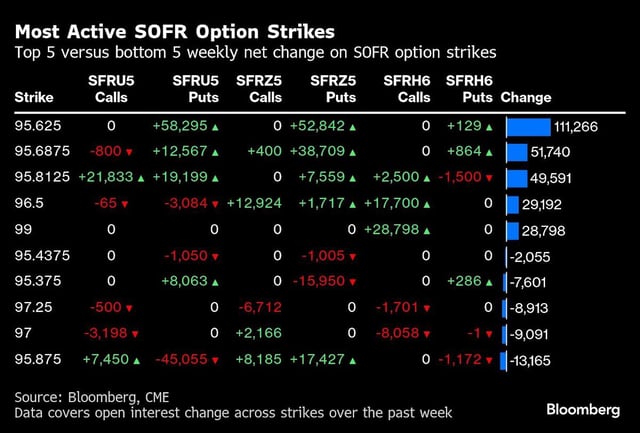

- Money markets now assign roughly a 20% probability to a rate cut in July and fully expect at least two quarter-point reductions by the end of the year.

- Investors are focused on Federal Reserve Chair Jerome Powell’s testimony today for further clues on policy direction and will also monitor upcoming GDP and PCE inflation data.