Overview

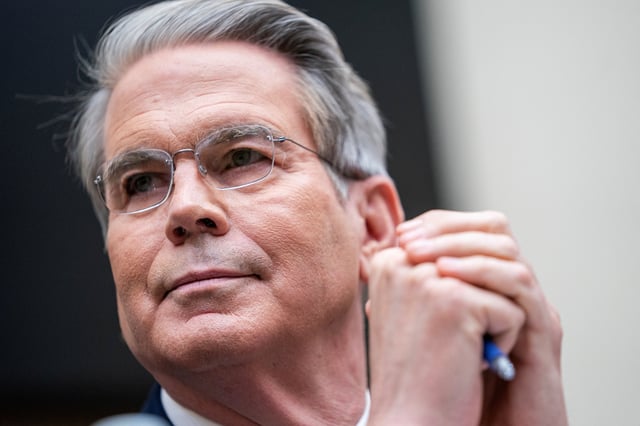

- Treasury Secretary Scott Bessent has formally requested Congress to address the debt ceiling by mid-July to avoid a potential default in August.

- The Treasury has been using extraordinary measures since January to meet financial obligations after the U.S. hit its $36 trillion debt limit.

- Bessent emphasized that waiting until the last minute to act could destabilize markets, harm consumer confidence, and increase borrowing costs.

- House Republicans aim to include a debt ceiling increase in a sweeping budget reconciliation bill advancing President Trump’s agenda, but internal divisions have delayed progress.

- A failure to address the debt ceiling could result in severe economic consequences, including a U.S. default and global financial instability.