Overview

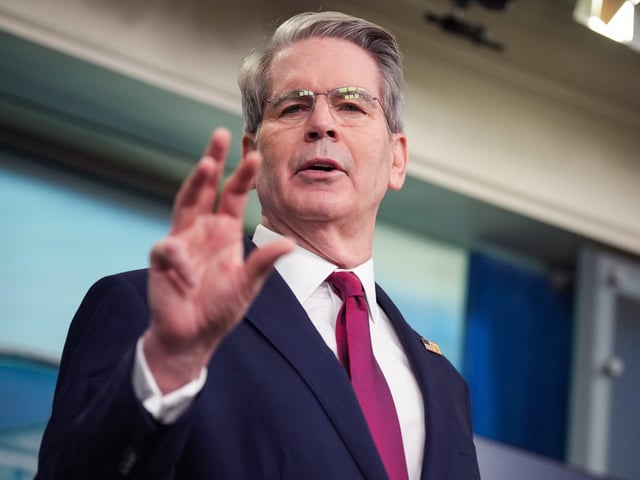

- Treasury Secretary Scott Bessent highlighted the inversion of the two-year Treasury yield, now at 3.75%, below the Federal Reserve’s policy rate range of 4.25%–4.5%, as a clear market signal for interest-rate cuts.

- Market participants anticipate the first Fed rate cut in June, with no action expected at the May 6–7 Federal Reserve meeting.

- The 10-year Treasury yield, a key economic indicator, currently stands at 4.15%, reflecting significant declines since January but ongoing volatility linked to shifting U.S. trade policies.

- President Trump has escalated public pressure on Federal Reserve Chair Jerome Powell, asserting his own expertise on interest rates while denying plans to remove Powell, fueling market uncertainty.

- Recent tariff announcements and pauses by the administration have driven import surges, contributing to fluctuations in Treasury yields and complicating economic forecasting.