Overview

- TotalEnergies agreed to sell a 50% interest in a 1.4 GW North American solar portfolio to insurance vehicles and accounts managed by KKR, expecting $950 million at closing on a $1.25 billion enterprise value, while retaining 50% ownership and operating control.

- The portfolio includes six utility-scale projects totaling 1.3 GW and 41 distributed generation sites totaling 140 MW, primarily in the United States, with output either contracted to third parties or to be marketed by TotalEnergies.

- On the same day, the company announced it will acquire a 49% interest in Continental Resources’ natural gas assets in the Anadarko Basin, Oklahoma, positioning for potential gross output near 350 MMscfd by 2030 and reinforcing its LNG-to-power integration.

- At its investor day, management outlined a $7.5 billion savings program for 2026–2030, trimmed capex guidance to $16 billion in 2026 and $15–17 billion annually from 2027–2030, and reaffirmed plans for electricity output of 100–120 TWh by 2030 with a 70% renewable and 30% flexible gas mix.

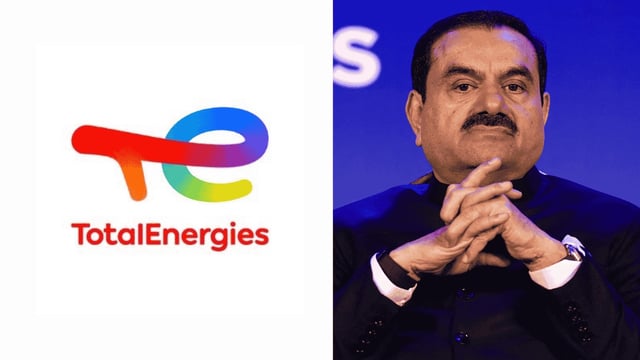

- Executives signaled plans to raise roughly $3.5 billion by year-end through asset sales and portfolio pruning, indicated they may sell their stake in Adani Green and exit non-core markets, and completed the sale of 50% of a 270 MW wind and solar portfolio in France.