Overview

- The study draws on data from the Administrative Office of the U.S. Courts, TransUnion, Google Trends and WalletHub’s own metrics to rank states across credit score changes, forbearance rates, bankruptcy trends and search activity.

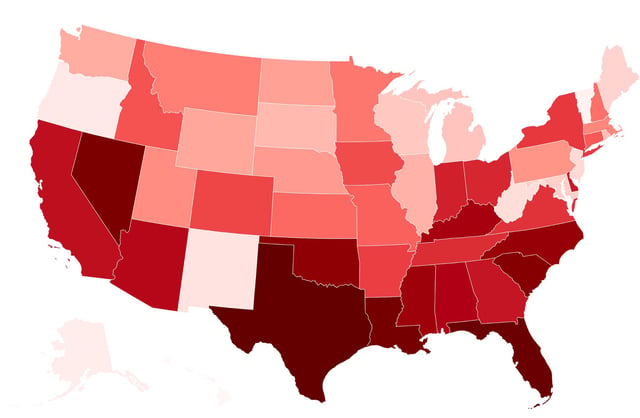

- Texas leads the rankings with its residents showing low average credit scores, high forbearance rates and elevated online searches for borrowing.

- Florida and Louisiana follow in second and third place with rising payment deferrals and frequent debt-related searches driving their scores.

- Eight of the ten most distressed states are located in the South or Sun Belt, highlighting the region’s disproportionate financial strain.

- Hawaii, Alaska and Vermont rank lowest in financial distress thanks to stronger credit health and fewer bankruptcy filings.