Overview

- The three-day tax-free holiday runs from Friday, Aug. 8 through midnight Sunday, Aug. 10 statewide.

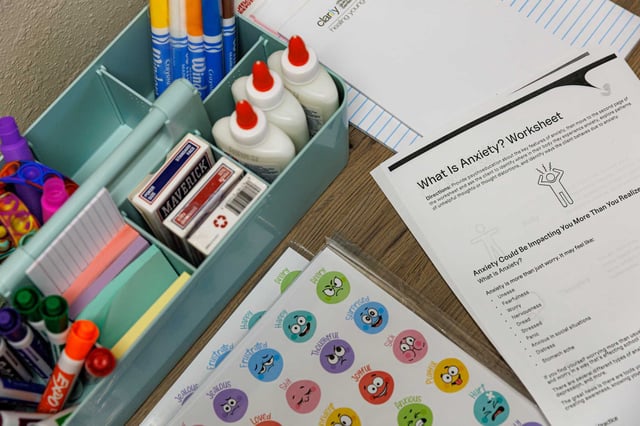

- Qualifying items include most clothing, footwear, backpacks and school supplies priced below $100 with no purchase limit or exemption certificate requirement.

- The tax holiday applies to in-store, online, mail and custom orders with eligibility determined by transaction date rather than delivery or shipping schedules.

- Delivery, shipping and handling fees count toward the $100 cap and can render items taxable if the total exceeds the limit.

- Shoppers who pay sales tax by mistake can request refunds from sellers or file Form 00-985 with the Comptroller’s office.